Embarking on the journey of online trading requires a partner that instills confidence and provides a robust environment. Finding the right online broker can be the cornerstone of your success, offering essential tools, unwavering support, and stringent security measures. This comprehensive exploration delves into Tickmill Broker, a name synonymous with reliability in the global financial markets, highlighting its diverse services and unique advantages. Whether you’re taking your first steps into trading or you’re a seasoned professional, understanding what a top-tier forex broker like Tickmill offers is fundamental to achieving your financial aspirations.

Why Tickmill Stands Out in the Forex Market

Tickmill has carved out a significant niche, earning a strong reputation for its transparent trading conditions and competitive pricing. Many traders worldwide choose Tickmill for its commitment to providing an optimal trading environment. This focus on client-centric services establishes Tickmill as a strong contender for anyone serious about their financial aspirations.

Here are some key reasons why traders gravitate towards Tickmill:

- Competitive Spreads: Enjoy some of the lowest spreads in the industry, significantly impacting your trading costs.

- Fast Execution: Benefit from ultra-low latency execution, essential for capitalizing on market movements.

- Robust Regulation: Operate with peace of mind knowing Tickmill adheres to strict regulatory standards.

- Diverse Instruments: Access a wide range of assets, including Forex, Indices, Commodities, and Cryptocurrencies.

Unveiling Tickmill’s Advanced Trading Platforms

At the heart of any effective trading experience lies a powerful trading platform. Tickmill understands this necessity, offering industry-standard platforms renowned for their functionality and user-friendliness. These platforms provide sophisticated tools for analysis, execution, and risk management, catering to various trading styles and preferences.

Tickmill provides access to the popular MetaTrader suite:

- MetaTrader 4 (MT4): A timeless classic, MT4 offers a powerful, user-friendly interface with advanced charting tools, technical indicators, and support for Expert Advisors (EAs). It remains a favorite for many forex traders globally.

- MetaTrader 5 (MT5): Building on MT4’s success, MT5 offers additional timeframes, more indicators, and an expanded range of order types. It provides access to a broader selection of markets beyond just forex, making it a versatile option.

Both platforms are available across multiple devices, ensuring you can manage your trades whether you are at your desk or on the go.

Account Types Designed for Every Trader

Tickmill offers various account types, each tailored to meet the specific needs and trading objectives of different clients. This flexibility ensures you can choose an option that aligns perfectly with your experience level and capital.

Here’s a brief overview of the main account options:

| Account Type | Key Feature | Target Trader |

| Classic Account | Commission-free trading | Beginners, those preferring simplicity |

| Pro Account | Raw spreads, low commissions | Experienced traders, scalpers, EA users |

| VIP Account | Ultra-low commissions, raw spreads | High-volume traders |

Each account type gives you access to the same high-quality execution and comprehensive suite of trading instruments, simply with different pricing structures.

Security and Regulation: Building Trust

Choosing an online broker means entrusting them with your capital. Therefore, the regulatory framework and security measures are paramount. Tickmill operates under the supervision of several reputable financial authorities, ensuring a high level of client protection and operational transparency.

“A solid regulatory foundation isn’t just a badge; it’s a testament to a broker’s commitment to protecting client interests and maintaining fair practices within the market.” – Trading Expert

Tickmill’s robust regulatory compliance gives traders confidence, knowing their funds are held in segregated accounts and the broker adheres to strict operational standards.

Exceptional Client Support and Educational Resources

Tickmill goes beyond just offering a trading platform; it provides comprehensive support and educational resources to empower its clients. Whether you need assistance with a technical issue or want to deepen your market knowledge, the support team and learning materials are readily available.

Explore the support and educational offerings:

- Multilingual Customer Support: Access assistance via live chat, email, or phone in multiple languages.

- Extensive Education Hub: Benefit from webinars, seminars, video tutorials, and articles covering various trading topics.

- Market Analysis: Stay informed with daily market news, technical analysis, and fundamental insights from expert analysts.

Pros and Cons of Trading with Tickmill

Making an informed decision involves weighing the advantages and potential drawbacks. Here is a balanced perspective on what Tickmill brings to the table:

Pros:

- Very competitive spreads and low commissions.

- Fast execution speed, ideal for active traders.

- Strong regulatory oversight for enhanced security.

- Access to popular MetaTrader 4 and 5 platforms.

- Excellent customer support and educational resources.

- Wide range of trading instruments.

Cons:

- Limited product range compared to multi-asset investment platforms.

- Minimum deposit for VIP account can be high for some traders.

Embark on Your Trading Journey with Tickmill

Tickmill Broker presents a compelling option for traders seeking a reliable, efficient, and transparent trading environment. Its combination of competitive pricing, advanced trading platforms, robust regulation, and dedicated client support makes it a standout choice in the crowded forex market. If you are looking for an online broker that prioritizes your trading experience, Tickmill merits serious consideration. Explore its services and discover how this established forex broker can support your financial goals.

Introduction to Tickmill Broker

Choosing the right partner for your financial journey is crucial, whether you’re a seasoned trader or just starting out. You need a reliable, efficient, and secure environment to navigate the dynamic world of online trading. This is where a top-tier service provider like Tickmill Broker truly shines.

Tickmill is a globally recognized forex broker, renowned for its unwavering commitment to excellent trading conditions and client satisfaction. As a leading online broker, Tickmill offers a robust platform designed to empower traders with the tools and resources they need to succeed. Their reputation is built on transparency, competitive pricing, and cutting-edge technology.

What makes Tickmill a preferred choice for countless traders worldwide? Let’s explore some of its defining characteristics:

- Competitive Spreads: Access some of the tightest spreads in the industry, significantly reducing your trading costs.

- Fast Execution: Experience lightning-fast order execution, vital for capitalizing on market movements without delay.

- Advanced Trading Platforms: Gain access to popular and powerful trading platform options, including MetaTrader 4 and MetaTrader 5, offering comprehensive charting tools, indicators, and automated trading capabilities.

- Strong Regulation: Trade with confidence, knowing Tickmill operates under strict regulatory oversight, ensuring client fund security and operational integrity.

- Dedicated Support: Benefit from multilingual customer support, ready to assist you whenever you need it.

Tickmill’s focus on providing a superior trading experience makes it an excellent choice for those seeking a professional and secure trading environment. Whether your interest lies in forex, indices, commodities, or cryptocurrencies, this online broker provides a diverse range of instruments. It’s more than just a trading platform; it’s a gateway to global markets, supported by a team dedicated to your trading success.

Ready to experience the difference? Join the growing community of traders who trust Tickmill for their investment needs. Explore their offerings and see how Tickmill can elevate your trading journey.

Regulatory Compliance and Licensing of Tickmill

Understanding the regulatory environment of your chosen financial service provider is paramount. For any reputable online broker, robust regulatory compliance is not just a legal requirement; it is a fundamental pillar of trust and security for clients. Tickmill Broker places immense importance on adhering to strict global financial standards, ensuring a secure and transparent trading experience for everyone.

Operating across various jurisdictions, Tickmill holds multiple licenses from prominent regulatory authorities worldwide. These licenses underpin its commitment to maintaining the highest levels of integrity and client protection. Each regulatory body imposes stringent requirements, which Tickmill diligently meets and often exceeds.

Key Regulatory Authorities Overseeing Tickmill:

- Financial Conduct Authority (FCA) in the UK: The FCA is one of the most respected financial regulators globally, known for its rigorous standards in investor protection and market integrity.

- Cyprus Securities and Exchange Commission (CySEC): As an EU-regulated entity, Tickmill falls under MiFID II directives, offering transparency and investor protection across Europe.

- Financial Sector Conduct Authority (FSCA) in South Africa: This authority ensures that financial institutions operate fairly and professionally within the region.

- Financial Services Authority (FSA) in Seychelles: The FSA provides oversight for international business activities, balancing innovation with client safety.

- Dubai Financial Services Authority (DFSA): Regulating financial services conducted in or from the Dubai International Financial Centre (DIFC), the DFSA upholds high standards for financial conduct.

Why does this extensive regulatory framework matter to you as a trader? These licenses provide a robust safety net, guaranteeing that Tickmill operates with complete transparency and accountability. It means your funds are handled with the utmost care, and the trading environment remains fair and equitable.

Benefits of Trading with a Regulated Forex Broker like Tickmill:

Choosing a regulated forex broker like Tickmill offers distinct advantages:

| Benefit | Description |

|---|---|

| Client Fund Segregation | Your deposits remain separate from the company’s operational funds, held in top-tier banks, safeguarding them even in unforeseen circumstances. |

| Investor Compensation Schemes | Depending on the specific license, you gain access to investor compensation funds, providing an added layer of protection for your capital. |

| Fair Trading Practices | Regulators enforce rules ensuring transparent pricing, efficient order execution, and prevention of market manipulation. |

| Regular Audits & Reporting | Independent auditors regularly scrutinize Tickmill’s financial health and operational procedures, ensuring ongoing compliance. |

| Clear Dispute Resolution | You have clear channels to address any concerns, often with access to external ombudsman services for unbiased resolution. |

This unwavering dedication to regulatory excellence strengthens the trust clients place in the Tickmill trading platform. It assures you that you are engaging with a broker committed to the highest ethical standards and client security. Tickmill continually reviews and updates its compliance protocols to adapt to the evolving global financial landscape, always prioritizing the safety and success of its traders.

Tickmill Account Types Offered

Choosing the right account type is crucial for your trading journey. As a leading online broker, Tickmill understands that every trader has unique needs, strategies, and capital. That’s why Tickmill Broker offers a range of carefully designed accounts, each tailored to provide an optimal trading experience. Our goal is to empower you with the right tools and conditions, whether you’re just starting out or you’re a seasoned professional navigating the global financial markets.

Let’s explore the distinct account types available from Tickmill, ensuring you find the perfect fit for your trading style.

Classic Account

The Classic Account serves as an excellent entry point for new traders or those who prefer straightforward trading without commissions. It’s designed to offer simplicity and ease of use, making it ideal for anyone learning the ropes of forex trading.

- No Commissions: Trade with spreads only, simplifying your cost structure.

- Competitive Spreads: Enjoy tight spreads even without commissions.

- Minimum Deposit: Accessible with a low initial deposit, making it perfect for beginners.

- Execution: Reliable execution on a robust trading platform, ensuring your orders are processed efficiently.

Pro Account

The Pro Account is engineered for experienced traders seeking highly competitive pricing and direct market access. This account thrives on tight spreads and a transparent commission structure, appealing to those who demand precision and efficiency in their trading.

- Ultra-Tight Spreads: Experience some of the market’s lowest spreads, starting from 0.0 pips on major currency pairs.

- Low Commissions: Benefit from highly competitive commission rates, making high-volume trading more cost-effective.

- Fast Execution: Ideal for scalping and high-frequency trading strategies, given its rapid order processing.

- Advanced Tools: Full access to a sophisticated trading platform, enhancing your analytical and execution capabilities.

VIP Account

For high-volume traders and institutional clients, the VIP Account offers unparalleled trading conditions and personalized service. This premium account type is for those who require the absolute best in terms of pricing, execution, and support from their forex broker.

- Lowest Commissions: Enjoy the most favorable commission rates available, significantly reducing your trading costs on large volumes.

- Deepest Liquidity: Access to superior liquidity pools ensures minimal slippage and optimal execution, even for large orders.

- Dedicated Support: Receive priority customer service with a dedicated account manager ready to assist with your specific needs.

- Exclusive Insights: Potentially gain access to exclusive market analysis and resources to further inform your trading decisions.

When you choose Tickmill, you’re not just selecting a trading platform; you’re partnering with an online broker committed to providing exceptional conditions tailored to your individual trading journey. Take the time to consider which account aligns best with your experience level, trading frequency, and capital. We are here to support your success in the dynamic world of online trading.

Classic Account Overview

Discover the Tickmill Classic Account, a popular choice designed for traders who appreciate straightforward conditions and reliable execution. This account offers a balanced approach, ideal for those seeking a transparent trading environment with a reputable Tickmill Broker. It delivers a solid foundation for both new and experienced traders, allowing you to focus on your strategy without unnecessary complexities.

Here’s what makes the Tickmill Classic Account stand out:

- Competitive Spreads: Enjoy tight spreads, helping to keep your trading costs efficient.

- Zero Commission: Trade with no commission on most instruments, simplifying your cost analysis.

- Wide Range of Instruments: Access popular Forex pairs, indices, commodities, and more.

- Flexible Leverage: Utilize leverage options tailored to your trading style and risk management.

Many traders choose this account type for its directness. It’s a fantastic entry point if you are new to the world of currency trading, providing a secure and supportive platform. Experienced traders also find value in its simplicity, making it easy to execute diverse strategies across various markets.

Is the Classic Account Right for You?

This account thrives on simplicity and direct access. It empowers you to trade without the added layers of commission structures, making it an excellent option for those who prefer an all-inclusive spread model. If you value a clear pricing structure and consistent performance from your online broker, the Classic Account delivers.

We invite you to experience the reliability of Tickmill as your dedicated forex broker. Ready to take the next step? Explore the Classic Account and see how it aligns with your trading goals on our robust trading platform.

Pro Account Benefits

Ready to elevate your trading experience? The Tickmill Broker Pro Account offers serious traders a suite of advantages designed to maximize potential and enhance efficiency. It is built for those who demand more from their forex broker, delivering an environment optimized for professional performance.

Unbeatable Pricing and Spreads

One of the standout benefits for our Pro Account holders is the exceptionally competitive pricing. You will experience some of the lowest spreads in the industry, starting from 0.0 pips on major currency pairs. Couple this with transparent, low commissions, and you have a cost-effective trading environment that truly makes a difference to your bottom line. We believe your profits should stay with you, and tickmill delivers on that promise.

Lightning-Fast Execution

In the fast-paced world of financial markets, every millisecond counts. Our Pro Account ensures ultra-fast trade execution, minimizing slippage and helping you capture market opportunities precisely. This rapid processing is crucial for scalpers and high-frequency traders, providing the reliability you need on our robust trading platform.

Key Advantages for Professionals

Beyond competitive pricing and speed, the Tickmill Pro Account comes packed with features tailored for discerning traders:

- Flexible Leverage: Access high leverage options, allowing you to optimize your capital efficiency according to your trading strategy and regulatory guidelines.

- Deep Liquidity: Benefit from deep liquidity sourced from top-tier providers, ensuring smooth order execution even on large volumes without significant price impact.

- Wide Range of Instruments: Gain access to a vast array of instruments, including forex, indices, commodities, and more, all from a single account.

- No Minimum Deposit: We remove barriers, making the Pro Account accessible for professional traders at various capital levels with no minimum deposit requirement.

Dedicated Support and Resources

As a professional online broker, we understand the importance of reliable support. Pro Account clients receive priority customer service, ensuring any queries or technical issues are addressed swiftly and effectively by experienced professionals ready to assist you. Join the ranks of discerning traders who choose tickmill for their professional trading needs.

VIP Account Exclusive Features

Serious traders understand that every edge counts. When you’re ready to elevate your trading experience, the VIP Account from the Tickmill Broker stands ready to deliver unparalleled advantages. This isn’t just an upgrade; it’s a meticulously crafted suite of benefits designed for those who demand the absolute best from their online broker.

Unlock premium conditions and dedicated support that goes beyond the standard offering. We focus on empowering your strategy with features that truly make a difference to your bottom line and overall trading efficiency.

- Ultra-Tight Spreads & Low Commissions: Gain access to some of the most competitive pricing in the market. This critical feature significantly reduces your trading costs, allowing more of your profits to stay in your account. High-volume traders will immediately recognize the immense value of Tickmill’s commitment to cost-effective execution.

- Dedicated Account Manager: Receive personalized support from an experienced professional. Your dedicated account manager understands your trading needs and provides tailored assistance, ensuring you always have expert guidance available. This bespoke service makes navigating the markets smoother and more efficient.

- Priority Processing & Swift Withdrawals: Experience expedited handling of all your requests, from deposits to withdrawals. We prioritize VIP client transactions, ensuring your funds move quickly and securely when you need them most, minimizing any delays on the trading platform.

- Exclusive Market Insights & Analysis: Stay ahead with access to premium research and in-depth market commentary not available to standard account holders. These exclusive insights empower you to make more informed decisions and identify potential opportunities in the dynamic forex market.

- Higher Flexibility & Tailored Conditions: Benefit from greater flexibility in trading parameters and the potential for customized trading conditions. This adaptability ensures your account perfectly aligns with your specific trading style and objectives as a discerning forex broker client.

The VIP Account at Tickmill is built for traders who are serious about maximizing their potential. Elevate your journey and experience trading at its peak.

Islamic Account (Swap-Free) Options

Understanding the diverse needs of traders globally is crucial, and at Tickmill Broker, we proudly cater to clients seeking Sharia-compliant trading solutions. Our Islamic Account, also known as a swap-free account, eliminates interest-based charges, aligning with Islamic financial principles. This option is a cornerstone of our commitment to inclusive and ethical trading practices, ensuring that your experience on our trading platform respects your beliefs.

For traders adhering to Sharia law, avoiding interest (riba) is paramount. This is where our specialized account comes into play, providing a seamless and worry-free environment. As a leading forex broker, Tickmill ensures that the integrity of your trading experience remains uncompromised.

Key Features of Tickmill’s Islamic Account:

- Swap-Free Trading: We remove overnight interest charges (swaps) on positions held open for more than 24 hours. This fundamental feature ensures compliance with Islamic finance.

- No Hidden Fees: Transparency is key. You will not encounter any hidden commissions or spreads added to compensate for the absence of swaps.

- Access to All Instruments: Trade a full range of assets, including major and minor currency pairs, commodities, and indices, without compromise.

- Ease of Conversion: Existing clients can effortlessly convert their standard accounts to an Islamic one, provided they meet the eligibility criteria.

Our dedication as an online broker extends beyond just providing a trading platform. We strive to create an environment where every trader feels supported and respected. The Islamic Account reflects this philosophy, offering a practical solution without sacrificing performance or access to market opportunities.

How to Apply for a Tickmill Islamic Account:

- New Clients: Register for a new trading account with Tickmill. During the application process, or once your account is live, you can request the Islamic Account option.

- Existing Clients: Log into your Client Area and submit a request to convert your existing Live Account to an Islamic Account. Our support team will guide you through the necessary steps.

Tickmill’s robust infrastructure supports this specialized account, ensuring that whether you’re a new or experienced trader, your swap-free experience is reliable and efficient. We manage the process diligently, ensuring all accounts meet the specific criteria for this unique trading option.

| Feature | Standard Account | Islamic Account (Swap-Free) |

|---|---|---|

| Overnight Swaps | Applied | Not Applied |

| Sharia Compliance | No | Yes |

| Access to Instruments | Full Range | Full Range |

We believe that your trading journey should align with your values. The Islamic Account from Tickmill Broker stands as a testament to our commitment to providing a comprehensive, ethical, and high-quality service for all our clients.

Trading Platforms Available at Tickmill

As a seasoned forex trader, you know your trading platform is the nerve center of your market operations. At Tickmill, we understand this critical need for robust, reliable, and feature-rich tools. We commit to providing you with industry-leading platforms, ensuring seamless access to global financial markets. Our aim is to empower every trader, from novice to expert, with the technology they need to succeed. When you choose Tickmill Broker, you invest in a superior trading experience tailored to your unique style.

MetaTrader 4 (MT4)

MetaTrader 4 remains the gold standard for countless forex traders worldwide, and it’s a core offering at Tickmill. Its enduring popularity stems from its powerful charting tools, wide array of technical indicators, and customizable interface. MT4 provides a stable and secure environment for executing trades with precision and efficiency.

- Intuitive Interface: Easy to navigate, even for newcomers.

- Advanced Charting: Access multiple timeframes and analytical objects.

- Expert Advisors (EAs): Automate your trading strategies with ease.

- Extensive Indicators: Utilize a vast library of built-in and custom indicators.

- Reliable Performance: Enjoy stable execution and minimal latency.

MetaTrader 5 (MT5)

For traders seeking an even broader range of features and instruments, MetaTrader 5 offers a significant upgrade. MT5 builds upon the strengths of its predecessor, delivering enhanced analytical tools, more timeframes, and additional order types. It provides a multi-asset trading platform, perfect for those who diversify beyond just forex.

- More Timeframes: Gain deeper market insights with additional chart intervals.

- Improved Depth of Market: See real-time market depth to make informed decisions.

- Additional Order Types: Access advanced pending orders for greater flexibility.

- Economic Calendar: Stay informed about crucial market events directly within the platform.

- Expanded Asset Classes: Trade a wider range of financial instruments alongside forex.

Tickmill WebTrader

Accessibility is key in the fast-paced world of trading. Our WebTrader platform gives you instant market access directly from your web browser, with no software download required. This convenient option ensures you can manage your trades and monitor the markets from any computer, anywhere, at any time. It’s the perfect solution for quick checks or when you’re away from your primary trading setup.

- Browser-Based Convenience: Trade directly from Chrome, Firefox, Safari, or Edge.

- Instant Access: Log in and start trading in seconds.

- User-Friendly Interface: Designed for ease of use without sacrificing functionality.

- Secure Connection: All your data remains protected.

Mobile Trading Applications

Never miss a market move with Tickmill’s robust mobile trading applications. Available for both iOS and Android devices, these apps bring the full power of our trading platform to the palm of your hand. Execute trades, monitor your portfolio, conduct technical analysis, and manage your account on the go. As a leading online broker, we empower you with tools designed for success, wherever you are.

- Full Account Management: Deposit, withdraw, and manage your funds seamlessly.

- Real-Time Quotes: Stay updated with live market prices.

- One-Tap Trading: Execute orders quickly and efficiently.

- Comprehensive Charting: Perform technical analysis with various indicators and drawing tools.

- Push Notifications: Receive alerts on price movements and order status.

Choosing the right trading platform is a personal decision, reflecting your trading style and needs. Whether you prefer the classic reliability of MT4, the advanced capabilities of MT5, the ultimate convenience of WebTrader, or the flexibility of mobile apps, Tickmill provides the tools to match. Explore our offerings today and discover why countless traders trust Tickmill for their trading journey.

MetaTrader 4 (MT4) Functionality

Dive into the world of trading with MetaTrader 4 (MT4), the premier trading platform offered by Tickmill Broker. This powerful software is a favorite among forex traders globally, known for its robust features and user-friendly interface. It provides everything you need to analyze markets and manage your trades effectively.

Tickmill’s integration with MT4 brings you a top-tier trading experience. You gain access to a comprehensive suite of tools designed to empower both novice and experienced traders. This renowned online broker ensures a stable and responsive environment for all your trading activities.

- Advanced Charting Tools: Explore an extensive array of technical indicators and analytical objects. Make informed decisions with detailed price analysis, essential for understanding market trends.

- Automated Trading with EAs: Employ Expert Advisors (EAs) to automate your trading strategies. This feature allows you to trade around the clock, leveraging market opportunities even when you are away from your screen.

- One-Click Trading: Execute trades swiftly and efficiently directly from the charts. This precision is critical in fast-moving markets, giving Tickmill users a significant edge.

- Multiple Order Types: Utilize various order types including market, pending, stop, and trailing stop orders. Manage your risk effectively and implement diverse trading strategies with ease.

- Customization and Personalization: Tailor the platform’s appearance and functionality to your unique preferences. Create custom indicators and scripts to enhance your personal trading platform experience.

Experience lightning-fast execution and reliable connectivity through this leading trading platform. Tickmill helps you capitalize on market movements with confidence, providing all the functionality you expect from a world-class forex broker.

| MT4 Feature | Direct Benefit with Tickmill |

|---|---|

| Comprehensive Tools | In-depth market analysis |

| Automation Capabilities | Effortless, 24/7 trading |

| Rapid Execution | Quick, precise trade entry |

| Flexible Order Types | Enhanced risk management |

MetaTrader 5 (MT5) Advanced Tools

Unlock superior trading potential with MetaTrader 5 (MT5), a cutting-edge trading platform that goes far beyond basic market analysis. As a client of a leading online broker like Tickmill Broker, you gain direct access to a suite of advanced tools designed to sharpen your trading edge and provide deeper market insights.

MT5 represents a significant leap in functionality compared to its predecessor, offering traders unparalleled capabilities. Here’s a look at some of the sophisticated features that empower your strategy:

- Depth of Market (DOM): Get a real-time view of market liquidity and order flow. This crucial tool helps you understand supply and demand dynamics, offering transparency on current bid and ask prices directly from your forex broker.

- Integrated Economic Calendar: Stay ahead of market-moving events without leaving your platform. The built-in economic calendar provides critical macroeconomic data releases and their impact, aiding your fundamental analysis.

- More Timeframes: Analyze markets across a wider range of intervals. MT5 boasts 21 distinct timeframes, giving you granular control for both short-term scalping and long-term trend following.

- Enhanced Strategy Tester: Optimize your Expert Advisors (EAs) with a multi-threaded, multi-currency backtesting environment. This powerful tool significantly speeds up the testing of complex strategies across various historical data sets.

- MQL5 Development Environment: For those who build custom solutions, the MQL5 programming language offers greater flexibility and power. Create your own indicators, scripts, and EAs to fully personalize your trading experience with tickmill.

These features are not just add-ons; they are fundamental improvements that contribute to a more comprehensive and robust trading experience. They provide the precision and speed modern traders demand in dynamic markets.

Here’s a quick overview of how MT5 takes your trading further:

| Feature | Benefit for Traders |

|---|---|

| Order Execution Types | Supports netting and hedging account systems, offering flexibility in strategy implementation. |

| Technical Indicators | Access 38 built-in indicators and over 2,000 free custom indicators, alongside 46 graphical objects. |

| Asset Classes | Trade not just forex, but also stocks, commodities, and indices from a single interface. |

“The advanced tools within MT5 provide a clearer lens into market dynamics. They turn raw data into actionable insights, crucial for making informed decisions on any asset class.”

Ultimately, a sophisticated trading platform like MT5, offered by a reputable forex broker, empowers you with the analytical firepower needed to navigate complex market conditions effectively. It helps you execute strategies with precision and manage your risk with greater confidence. Elevate your trading journey with the robust capabilities of MT5 through your partnership with Tickmill.

Tradable Instruments with Tickmill

Ready to unlock a universe of trading possibilities? As a premier online broker, Tickmill empowers you to navigate global financial markets with confidence. We understand that diverse interests demand diverse options, which is why our selection of tradable instruments caters to every strategy and ambition.

Here’s a closer look at the exciting markets you can access with Tickmill Broker:

Foreign Exchange (Forex)

Dive into the world’s largest and most liquid financial market. As a leading forex broker, Tickmill offers an extensive array of currency pairs, allowing you to speculate on the exchange rate movements between different countries. Trade major pairs like EUR/USD, GBP/JPY, or explore the volatility of minors and exotics. The forex market operates 24/5, providing constant opportunities to react to global economic shifts.

Stock Indices

Gain exposure to the performance of entire economies or sectors without buying individual stocks. Tickmill provides access to a wide range of global stock indices, including popular ones from the US, Europe, and Asia. Trading indices allows you to diversify your portfolio and capitalize on broader market trends with a single position.

Commodities

Hedge against inflation or speculate on supply and demand dynamics with essential commodities. Our platform lets you trade Contracts for Difference (CFDs) on precious metals like Gold and Silver, revered safe-haven assets. You can also engage with energy commodities such as Crude Oil, which often reacts to geopolitical events and industrial demand. These instruments offer a unique avenue for market participation.

Bonds

Explore sovereign debt markets through bond CFDs. Bonds are often seen as a staple for those seeking stability and are influenced by interest rates and economic outlooks. Trading bond CFDs with Tickmill allows you to diversify your trading strategies and potentially benefit from movements in global government bond prices without directly owning the underlying asset.

Cryptocurrencies

Step into the fast-paced world of digital assets. Tickmill offers CFDs on some of the most popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. This allows you to trade the exciting volatility of these innovative assets without the need for a crypto wallet or direct ownership. It’s an accessible way to engage with a rapidly evolving market.

Stock CFDs

Trade the price movements of individual company shares from some of the world’s largest exchanges. With Tickmill, you can access CFDs on a broad selection of global stocks, offering the potential to go long or short. This flexibility means you can potentially profit from both rising and falling markets, all from your integrated trading platform.

The variety available through tickmill ensures you can build a diversified portfolio that aligns with your risk tolerance and market outlook. Explore these powerful instruments and unlock your trading potential today!

Spreads, Commissions, and Fees at Tickmill

Understanding the costs associated with trading is paramount for any investor. As an experienced online broker, Tickmill strives for exceptional transparency in its pricing structure. We’re diving deep into the spreads, commissions, and fees at Tickmill so you know exactly what to expect from this reputable forex broker.

Spreads at Tickmill

Tickmill provides highly competitive spreads across its various account types. The spread represents the difference between the bid and ask price for a currency pair or other asset. Tickmill’s model focuses on offering some of the tightest spreads in the industry, which is crucial for active traders.

- Pro Account: Enjoy spreads starting from 0.0 pips on major currency pairs, plus a commission. This account targets serious traders looking for the absolute tightest pricing.

- Raw Account: Similar to Pro, this account is specifically designed for scalpers and high-volume traders, offering incredibly low spreads and a fixed commission.

- Classic Account: This option offers commission-free trading with slightly wider, but still competitive, spreads starting from 1.6 pips. It is perfect for those who prefer an all-inclusive spread model.

This flexible structure allows traders to choose an option that best fits their trading strategy on our robust trading platform.

Commissions Structure

For accounts with razor-thin spreads, such as the Pro and Raw accounts, Tickmill employs a clear commission structure. This is a common practice among ECN brokers to ensure direct market access and true interbank pricing. Tickmill keeps its commissions highly competitive:

| Account Type | Commission (per side, per standard lot) |

|---|---|

| Pro Account | $2 |

| Raw Account | $2 |

| Classic Account | None |

These commissions are among the lowest you will find for an online broker, directly contributing to your overall profitability when using the Tickmill trading platform.

Other Fees to Consider

Beyond spreads and commissions, Tickmill maintains a lean fee structure. We believe in keeping costs low and transparent, allowing you to focus on your trading strategies.

- Deposit and Withdrawal Fees: Tickmill generally covers deposit fees. You typically will not encounter withdrawal fees from Tickmill itself for most common methods, though intermediary banks might charge their own fees for transfers.

- Inactivity Fees: Rest assured, Tickmill does not charge inactivity fees. Your account remains free of charge even if you take a break from trading.

- Overnight/Swap Fees: Like most forex brokers, Tickmill applies swap rates for positions held overnight. These rates can be positive or negative, depending on the instrument and prevailing market conditions.

- Currency Conversion Fees: If your trading account currency differs from the base currency of the instrument you are trading, a small conversion fee might apply during transactions.

Tickmill Broker stands out by offering a highly competitive and transparent pricing model. Whether you prioritize ultra-low spreads or commission-free trading, Tickmill provides options designed to enhance your trading experience. This commitment to fair pricing solidifies its position as a top-tier forex broker. Ready to experience transparent trading? Join Tickmill today.

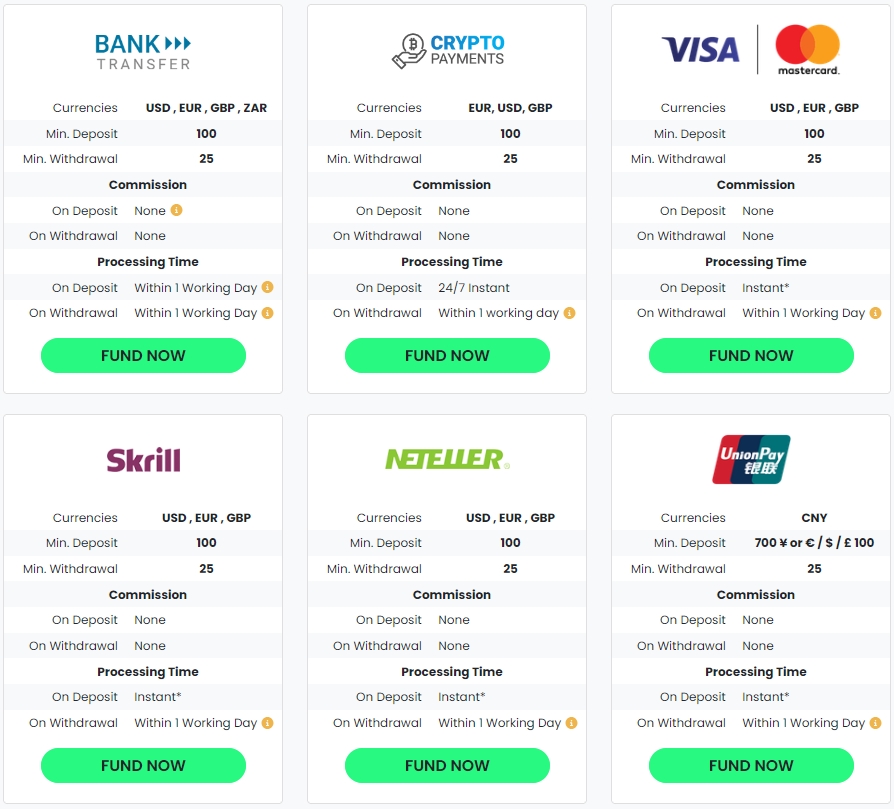

Deposit and Withdrawal Methods for Tickmill Clients

Starting your journey with a reliable online broker like Tickmill means ensuring your funds move efficiently and securely. Whether you are funding your trading platform or withdrawing your profits, understanding the available options is crucial. Tickmill Broker prioritizes speed and convenience, offering a range of methods tailored to meet diverse client needs globally.

Getting capital into your account should be straightforward, allowing you to focus on the markets. Tickmill provides various robust deposit methods, designed for instant or near-instant processing. This means less waiting and more trading.

- Bank Wire Transfer: A traditional and reliable method, suitable for larger amounts. Processing typically takes a few business days.

- Credit/Debit Cards (Visa, MasterCard): Widely used for instant deposits. Simply link your card and fund your account securely.

- E-Wallets (Skrill, Neteller, FasaPay, SticPay, ecoPayz): These popular digital payment solutions offer swift and secure transactions, often processing deposits instantly.

- Local Bank Transfers: Available in select regions, allowing for convenient funding directly from your local bank.

Cashing out your profits should be just as seamless and secure as depositing. Tickmill ensures a transparent and efficient withdrawal process, reflecting its commitment as a leading forex broker.

- Bank Wire Transfer: The most common method for larger withdrawals, ensuring funds are sent directly to your bank account.

- Credit/Debit Cards: Funds can often be returned to the original card used for deposit, subject to card issuer policies.

- E-Wallets (Skrill, Neteller, FasaPay, SticPay, ecoPayz): Withdrawals to these e-wallets are typically processed quickly once approved.

Understanding how long transactions take and any associated costs is vital. Tickmill aims for transparency in all financial operations. While many deposits are instant, withdrawals require internal processing for security and compliance, usually completed within one business day by Tickmill itself. Actual receipt of funds then depends on the chosen method’s external processing time.

| Method | Deposit Time | Withdrawal Time |

|---|---|---|

| Credit/Debit Cards | Instant | 1 business day (Tickmill processing) + 3-5 business days (bank processing) |

| E-Wallets (Skrill, Neteller, etc.) | Instant | 1 business day (Tickmill processing) + Instant (after processing) |

| Bank Wire Transfer | 2-5 business days | 1 business day (Tickmill processing) + 3-7 business days (bank processing) |

Tickmill generally covers deposit fees for most methods. For withdrawals, while Tickmill does not charge internal fees on many methods, intermediary bank fees or fees charged by payment providers might apply depending on the method and transaction amount. Always check the specific terms for your chosen method within your Tickmill client area.

Your financial security remains a top priority for this trusted online broker. Tickmill employs advanced encryption and strict regulatory compliance to protect your funds and personal information during all deposit and withdrawal transactions. This commitment to security, combined with a user-friendly interface, makes managing your capital on the Tickmill trading platform both safe and effortless. Ready to experience seamless financial operations? Join Tickmill today.

Tickmill Customer Support and Service Quality

In the fast-paced world of online trading, having access to reliable, prompt, and knowledgeable customer support is not just a luxury—it’s an absolute necessity. As a dedicated forex broker, Tickmill understands this critical need, positioning client assistance as a cornerstone of its service. We believe that top-tier support empowers traders, helping them navigate market complexities and manage their accounts with confidence.

Direct Channels for Immediate Assistance

Tickmill ensures you always have a direct line to help when you need it most. Our support team operates with efficiency, ready to address your concerns and provide clear solutions. We offer several convenient channels to connect with us:

- Live Chat: Get instant responses to urgent queries directly from the Tickmill website. This is often the quickest way to resolve minor issues or get immediate clarification.

- Email Support: For more detailed inquiries or when you need to attach documents, our email support provides comprehensive answers. We aim for prompt turnaround times, ensuring you are not left waiting.

- Phone Support: Prefer to speak with someone directly? Our dedicated phone lines connect you with experienced professionals who can guide you through various situations, from account setup to trading platform functionalities.

These channels are typically available during core trading hours, supporting a global client base through the active trading week.

Expertise and Responsiveness You Can Trust

The quality of support hinges on the knowledge and dedication of the people behind it. At Tickmill, our support specialists are highly trained, possessing a deep understanding of the financial markets, our proprietary trading platform, and all aspects of account management. They handle a wide array of topics, from technical troubleshooting to deposit and withdrawal procedures, always providing accurate and helpful guidance.

We pride ourselves on our responsiveness. Here’s a general expectation for how quickly you can anticipate getting help:

| Support Channel | Typical Response Time |

|---|---|

| Live Chat | Instant (usually within seconds) |

| Phone Support | Immediate (during operating hours) |

| Email Support | Within a few hours (often faster) |

Multilingual Support for a Global Community

As an international online broker, Tickmill serves a diverse clientele spanning numerous countries and cultures. To effectively support this global community, we offer assistance in multiple languages. This commitment ensures that language barriers do not hinder your access to vital information or problem resolution, making your trading experience seamless and inclusive.

Comprehensive Self-Help Resources

Beyond direct interaction, Tickmill empowers its clients with an extensive library of self-help resources. Our website features detailed FAQs, comprehensive guides, and educational materials that cover everything from basic trading concepts to advanced strategies. These resources often provide immediate answers to common questions, allowing you to find solutions independently and quickly, further enhancing your overall experience with Tickmill Broker.

Educational Resources for Tickmill Traders

Embarking on the trading journey, or even refining your existing strategies, demands continuous learning. Success in the dynamic financial markets doesn’t happen by chance; it comes from a solid understanding and disciplined application. This is precisely why Tickmill Broker places a strong emphasis on empowering its traders with extensive educational resources, designed to build confidence and enhance decision-making. We believe that a well-informed trader is a more successful trader, regardless of their experience level with an online broker.

Tickmill is committed to supporting your growth every step of the way. Our comprehensive suite of educational materials caters to various learning styles and experience levels, ensuring that whether you are just starting or looking to hone advanced techniques, you have access to valuable insights. Mastering the nuances of the market on our trading platform becomes much clearer with the right guidance.

You gain access to a rich library covering fundamental concepts, technical analysis, risk management, and market psychology. Here’s a glimpse into the diverse learning opportunities available through Tickmill:

- In-Depth Trading Guides: Explore meticulously crafted articles and tutorials that break down complex trading topics into digestible insights. From understanding economic indicators to implementing specific chart patterns, these guides serve as your foundational knowledge base.

- Expert-Led Webinars and Seminars: Engage directly with market analysts and seasoned traders through live online webinars. These interactive sessions often cover current market trends, practical strategy applications, and provide opportunities for real-time Q&A.

- Practical Video Tutorials: Learn visually with our library of video content. These tutorials simplify intricate concepts, demonstrate platform features, and walk you through various trading scenarios, making abstract ideas tangible.

- Market Analysis and Research: Stay ahead with daily market analysis, expert commentary, and comprehensive research reports. These resources help you interpret market movements and identify potential trading opportunities.

- Trading Glossary: Quickly familiarize yourself with essential trading terminology. Our comprehensive glossary ensures you understand the language of the financial markets, removing barriers to entry.

We structure our educational content to ensure a progressive learning path. Discover how different resources complement each other to enrich your understanding:

| Learning Focus | Primary Resource | Benefit |

|---|---|---|

| Foundational Knowledge | Trading Guides, Glossary | Build a strong understanding of market basics and terminology. |

| Practical Application | Video Tutorials, Demo Account | Learn how to execute trades and navigate the trading platform without risk. |

| Advanced Strategies | Webinars, Advanced Articles | Gain insights into sophisticated trading techniques and market analysis. |

| Market Awareness | Daily Analysis, Research | Stay updated on global events impacting the forex market. |

Whether you are seeking to understand the basics of forex trading, looking to refine your technical analysis skills, or aiming to develop robust risk management strategies, the educational tools provided by this forex broker are invaluable. We empower every individual to take control of their learning journey. Dive into the resources today and equip yourself with the knowledge needed to navigate the markets with confidence.

Research Tools and Market Analysis by Tickmill

Navigating the financial markets successfully demands more than just intuition; it requires sharp analysis and robust tools. As a seasoned forex broker, Tickmill understands this perfectly. We empower traders with an impressive suite of research tools designed to help you make informed decisions, whether you are a beginner or a seasoned professional. Our goal is to provide clarity in a complex market, ensuring you have every advantage.

Tickmill Broker offers an integrated approach to market analysis directly within our trading platform. You gain access to essential resources that demystify market movements and help you spot potential opportunities.

Here’s a glimpse into the powerful research tools at your disposal:

- Comprehensive Economic Calendar: Stay ahead of major market-moving events with our real-time economic calendar. Track key economic indicators, central bank announcements, and geopolitical developments from around the globe. This crucial tool helps you anticipate volatility and plan your trades around high-impact news.

- Expert Market Analysis: Our team of seasoned analysts provides daily and weekly market insights. These reports offer in-depth perspectives on various asset classes, including forex, indices, and commodities. You get concise summaries and actionable commentary, giving you a valuable edge in understanding market sentiment and trends.

- Advanced Charting Capabilities: Utilize sophisticated charting tools directly on your trading platform. Access a wide range of technical indicators, drawing tools, and multiple chart types to conduct thorough technical analysis. Identify patterns, predict potential price movements, and validate your trading strategies with precision.

- Fundamental Data Resources: Dive deeper into the underlying factors driving market prices. Access data related to company financials, industry news, and macroeconomic reports. This helps you build a strong foundational understanding for your trading decisions, moving beyond just price action.

- Trader’s Sentiment Tools: Understand what other traders are thinking. Some of our integrated tools provide insights into market sentiment, showing you the distribution of long and short positions among other online broker clients. This can be a useful contrarian or confirming indicator for your own analysis.

We believe that knowledge is power. The research tools and market analysis provided by Tickmill are more than just features; they are a commitment to your trading success. They are thoughtfully integrated into our trading platform to ensure easy access and a seamless analytical experience. Ready to elevate your trading game with comprehensive insights? Explore what Tickmill offers and start making more informed decisions today.

Safety of Funds and Security Measures at Tickmill

When you enter the dynamic world of online trading, safeguarding your capital becomes paramount. As a top-tier forex broker, Tickmill understands this concern deeply. They implement robust measures to protect your funds and personal information, allowing you to focus on your trading strategies with complete peace of mind.

Regulatory Oversight and Compliance

Tickmill operates under stringent regulatory frameworks, ensuring transparency and accountability. This commitment to compliance is a cornerstone of their security infrastructure. The Tickmill Broker adheres to directives from multiple respected financial authorities worldwide, offering clients an additional layer of protection.

Here’s a quick look at some of the key regulatory bodies overseeing Tickmill:

| Entity | Jurisdiction | Oversight |

|---|---|---|

| Tickmill UK Ltd | United Kingdom | Financial Conduct Authority (FCA) |

| Tickmill Europe Ltd | Cyprus | Cyprus Securities and Exchange Commission (CySEC) |

| Tickmill Asia Ltd | Seychelles | Financial Services Authority (FSA) |

Operating under such reputable licenses means the online broker consistently meets high capital adequacy requirements and maintains proper internal procedures.

Client Fund Protection Protocols

Beyond regulatory compliance, Tickmill employs several critical safeguards directly impacting your funds. These measures aim to separate client assets from the firm’s operational capital, providing insulation against unforeseen circumstances.

- Segregated Client Accounts: Tickmill holds all client funds in separate bank accounts at top-tier banks, entirely isolated from the company’s own funds. This crucial step ensures that your money remains untouched, even if the company faces financial difficulties.

- Negative Balance Protection: This vital feature protects clients from incurring losses beyond their initial deposit. Should market volatility cause your account balance to fall below zero, Tickmill automatically adjusts it back to zero. You never owe more than you deposit on their trading platform.

- Investor Compensation Schemes: Depending on the specific Tickmill entity you trade with, your funds may be protected by an Investor Compensation Fund. For instance, clients of Tickmill Europe Ltd may be eligible for compensation under the CySEC Investor Compensation Fund. This provides an extra layer of security for your investments.

Advanced Data Security Measures

Protecting your personal and financial data is just as critical as securing your funds. Tickmill uses state-of-the-art technology to ensure your information remains confidential and impenetrable.

They utilize robust encryption protocols, such as Secure Socket Layer (SSL) technology, across their website and client portals. This encrypts all data transmitted between your device and their servers, preventing unauthorized access. Furthermore, they implement advanced firewall protection and employ strict physical and electronic security procedures to guard against cyber threats, offering a secure environment for every trader who chooses this trusted forex broker.

Tickmill Mobile Trading Experience

Mobile trading is no longer a luxury; it’s a necessity for modern traders. The ability to manage your portfolio, execute trades, and stay informed from anywhere defines true flexibility. Tickmill understands this perfectly, offering a robust mobile trading platform designed to keep you connected to the dynamic financial markets.

The Tickmill mobile app delivers a powerful trading experience directly to your smartphone or tablet. It ensures you have constant access to your account and the markets, empowering you to react swiftly to new opportunities. This crucial tool allows you to maintain control over your trading strategy, no matter your location.

Key Features of the Tickmill Mobile App:

- Intuitive Interface: Navigating the app is straightforward, whether you’re new to trading or a seasoned professional. Find what you need quickly and efficiently.

- Full Trading Functionality: Access all the core features you expect from a top-tier online broker. Place market orders, set stop-losses, take profits, and manage pending orders with ease.

- Real-time Data & Charts: Get live price feeds and advanced charting tools right on your mobile device. Analyze market trends and make informed decisions on the go.

- Comprehensive Account Management: Deposit funds, withdraw profits, and monitor your account balance with just a few taps. It’s a complete solution for managing your trading activity.

- Security First: Your financial security is paramount. The Tickmill app uses advanced encryption to protect your data and transactions, providing peace of mind.

For active traders, the Tickmill mobile experience means never missing a trading opportunity. Imagine being able to react to breaking news or sudden market shifts while commuting, traveling, or simply away from your desk. This level of accessibility empowers you to maintain control over your trading strategy wherever life takes you. It’s a crucial offering from a leading forex broker.

Consider the benefits of agility that the mobile app provides:

| Aspect | Desktop Experience | Mobile Experience |

|---|---|---|

| In-depth Analysis | Ideal for comprehensive research, multi-monitor setups | Quick trend checks, on-the-go insights |

| Trade Execution | Precision with multiple windows, complex strategies | Instant response to market changes, swift order placement |

| Account Monitoring | Detailed overview of all positions and history | Always-on access, quick status checks and balance updates |

“Having access to the Tickmill trading platform on my phone transformed how I manage my trades. It’s incredibly convenient to check positions and execute quick trades no matter where I am,” says a satisfied user. This highlights the practical benefits of a well-designed mobile trading platform.

The Tickmill Broker delivers a seamless and powerful mobile experience. Embrace the freedom and flexibility of managing your trading activity directly from your pocket. Discover how this intuitive platform supports your trading journey, keeping you ahead in the dynamic financial markets.

Why Choose Tickmill for Your Trading Journey

When you embark on your trading journey, selecting the right online broker makes all the difference. Tickmill stands out as a premier choice for traders globally, offering a robust and reliable environment built for success. This isn’t just another platform; it’s a comprehensive ecosystem designed to empower you with cutting-edge tools and unparalleled support. Let’s explore the compelling reasons why many experienced traders trust the Tickmill Broker with their capital.

Competitive Trading Conditions

Tickmill is renowned for its commitment to offering highly competitive trading conditions. We understand that every pip matters, which is why you will find some of the industry’s tightest spreads and low commissions here. This cost-effectiveness significantly enhances your potential profitability, making your trading more efficient. Coupled with lightning-fast execution speeds, your orders process quickly, helping you capitalize on market opportunities precisely when they arise.

Robust Regulation and Client Fund Security

Your capital’s safety is our top priority. Tickmill operates under stringent regulation by multiple reputable financial authorities, providing a secure and transparent trading environment. We segregate client funds from company operational capital in tier-1 banks, offering an additional layer of protection. This dedication to security ensures you can trade with complete peace of mind, knowing your investments are safeguarded by industry-leading practices.

Advanced Trading Platform and Technology

Success in the markets demands powerful tools. Tickmill provides access to a world-class trading platform, equipped with advanced charting capabilities, comprehensive analytical tools, and customizable interfaces. Whether you prefer desktop, web, or mobile trading, our technology ensures a seamless and responsive experience. Execute trades, monitor your portfolio, and analyze market trends from anywhere, anytime, with confidence and precision.

Exceptional Support and Educational Resources

Navigating the complexities of financial markets becomes much easier with the right support. Tickmill offers dedicated, multilingual customer service available to assist you promptly with any queries. Beyond support, we invest in your growth through extensive educational resources, including webinars, market analysis, and tutorials. These resources cater to both novice and seasoned traders, helping you sharpen your skills and make informed decisions.

Diverse Product Portfolio

As a leading forex broker, Tickmill presents a wide array of instruments beyond just foreign exchange. You gain access to a diverse product portfolio that includes indices, commodities, bonds, and cryptocurrencies, all from a single account. This variety allows you to diversify your trading strategies and explore multiple markets, expanding your potential for profit and managing risk effectively across different asset classes.

Here’s a quick overview of why traders choose Tickmill:

| Key Benefit | Description |

|---|---|

| Low Costs | Enjoy tight spreads and minimal commissions. |

| High Security | Regulated broker with segregated client funds. |

| Advanced Tools | State-of-the-art trading platform and analytical features. |

| Global Markets | Access a broad range of instruments. |

| Client Support | Responsive customer service and educational materials. |

Pros and Cons of Trading with Tickmill Broker

Understanding the strengths and weaknesses of any financial service is vital before you commit. Tickmill Broker offers a robust environment for traders, but like any online broker, it comes with its own set of advantages and potential drawbacks. Let’s break down what makes Tickmill a preferred choice for many, and where you might want to consider your options.

The Advantages of Choosing Tickmill

Traders often choose Tickmill for several compelling reasons. The overall trading experience is designed to be efficient and cost-effective.

- Highly Competitive Spreads: Tickmill is renowned for its low spreads, particularly on major currency pairs. This can significantly reduce your trading costs over time, making it an attractive forex broker for active traders.

- Fast Execution Speeds: The infrastructure supporting the trading platform ensures swift order execution. This is critical for strategies like scalping or day trading where even milliseconds can impact profitability.

- Strong Regulatory Oversight: Tickmill Broker operates under regulation by several reputable bodies, including the FCA in the UK and CySEC in Cyprus. This provides a high level of security and peace of mind for clients regarding fund segregation and operational transparency.

- Access to Popular Trading Platforms: You can trade using industry-standard platforms like MetaTrader 4 and MetaTrader 5. These powerful trading platforms offer extensive charting tools, technical indicators, and automated trading capabilities, catering to both novice and experienced traders.

- Diverse Account Types: Tickmill provides various account types, including Classic, Pro, and VIP, each tailored to different trading styles and volumes. This flexibility allows traders to choose an option that best suits their capital and trading strategy.

- No Requotes: The commitment to no requotes on trade orders means you get the price you click, enhancing fairness and transparency in your trading activities.

Potential Disadvantages of Trading with Tickmill

While Tickmill excels in many areas, it’s also important to be aware of where it might fall short compared to other platforms. Considering these points helps you make an informed decision about this online broker.

- Limited Product Range: While excellent for forex and CFDs, Tickmill’s offering of other financial instruments like stocks, ETFs, or cryptocurrencies (beyond CFDs) is more restricted compared to some multi-asset brokers. If you prefer a very wide array of instruments under one roof, you might find it somewhat narrow.

- Fewer Deposit/Withdrawal Options for Some Regions: While common methods are covered, some niche or regional payment methods might not be available, which could be an inconvenience for certain international clients.

- No 24/7 Customer Support: Customer support is highly responsive during business hours, but it isn’t available around the clock, which can be an issue for traders operating in vastly different time zones who require immediate assistance outside of standard operating hours.

- Minimum Deposit Requirements: While generally accessible, the minimum deposit for certain account types might be higher than some absolute beginner-friendly online brokers, potentially acting as a barrier for those starting with very small capital.

In summary, Tickmill Broker is a strong contender for traders prioritizing low costs, fast execution, and a reliable regulatory environment, particularly within the forex and CFD markets. Weighing these pros and cons against your individual trading needs will guide your choice.

Tickmill Broker’s Reputation and User Reviews

When you choose an online broker, reputation stands as a cornerstone of your decision-making process. For many traders, the credibility and track record of a forex broker directly impact their confidence. Tickmill Broker, a prominent name in the financial markets, consistently generates discussion among its global user base. We delve into its standing and what users say about their experiences.

Analyzing a broad spectrum of user reviews provides a clearer picture of what to expect. Traders often highlight specific areas when discussing their experience with Tickmill. Positive feedback frequently centers on the efficiency of the trading platform and the competitive pricing.

| Area of Feedback | Common Sentiment |

|---|---|

| Trading Platform Stability | Users frequently praise the reliability and smooth operation of the trading platform, minimizing disruptions during critical market movements. |

| Spreads & Fees | Many reviews commend Tickmill for its competitive spreads and transparent fee structure, which directly impacts trading costs. |

| Customer Support Responsiveness | Feedback often points to helpful and prompt customer service, resolving queries effectively across different channels. |

| Withdrawal Process | The efficiency and speed of processing withdrawals receive positive mentions, building trust in the online broker. |

| Educational Resources | Some users appreciate the available educational tools and market analysis, enhancing their trading knowledge. |

However, like any online broker, Tickmill also faces areas where users seek improvements. Sometimes, specific advanced features or niche market access draw requests for expansion. A thorough evaluation of reviews reveals a generally positive sentiment, balanced with constructive suggestions for future enhancements.

The regulatory framework supporting Tickmill significantly bolsters its reputation. Operating under strict supervision from multiple top-tier financial authorities gives traders peace of mind. This commitment to regulatory compliance assures clients that their funds are segregated and protected, a crucial factor when choosing a forex broker. Such robust oversight builds a foundation of trust that resonates strongly in user reviews and overall market perception of Tickmill Broker.

“A broker’s true colors emerge in moments of market volatility and through their withdrawal process. Tickmill consistently performs well in these critical areas, securing a strong vote of confidence from its trading community.”

– A seasoned industry observer

Exceptional customer support invariably shapes an online broker’s reputation. Tickmill invests in a multi-lingual support team accessible through various channels. Rapid response times and knowledgeable assistance transform potentially frustrating issues into positive service experiences. This dedication to client satisfaction reflects directly in the feedback, where efficient problem-solving contributes significantly to positive user sentiment around the Tickmill brand.

Overall, the reputation of Tickmill Broker appears robust, supported by a significant volume of positive user reviews. Its commitment to a reliable trading platform, competitive pricing, strong regulatory compliance, and responsive customer service clearly contributes to its favorable standing. As an established forex broker, Tickmill continues to attract and retain traders who value transparency, efficiency, and security in their online trading journey.

Frequently Asked Questions

What makes Tickmill a preferred choice among online brokers?

Tickmill is highly regarded for its transparent trading conditions, competitive spreads (starting from 0.0 pips on Pro accounts), ultra-low latency execution, and robust regulatory oversight from multiple financial authorities. It also offers a diverse range of tradable instruments and excellent client support.

Which trading platforms does Tickmill provide?

Tickmill offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting, technical indicators, and automated trading capabilities. Additionally, clients can access the convenient Tickmill WebTrader and dedicated mobile trading applications for iOS and Android devices.

What types of trading accounts are available at Tickmill?

Tickmill provides several account types to suit different needs: the Classic Account for commission-free trading, the Pro Account for experienced traders seeking raw spreads and low commissions, and the VIP Account for high-volume traders with ultra-low commissions. Islamic (Swap-Free) account options are also available.

How does Tickmill ensure the safety of client funds?

Tickmill prioritizes fund security by operating under strict regulatory frameworks (e.g., FCA, CySEC), segregating client funds in top-tier bank accounts separate from company capital, providing Negative Balance Protection, and participating in Investor Compensation Schemes in relevant jurisdictions.

What educational resources does Tickmill offer to its traders?

Tickmill is committed to trader education, offering an extensive range of resources including in-depth trading guides, expert-led webinars and seminars, practical video tutorials, daily market analysis from seasoned analysts, and a comprehensive trading glossary to help traders of all levels enhance their market knowledge and skills.